food sales tax in pa

All have sales tax but each state gets to govern sales tax in their. This can get tricky with products like food which are often considered necessities when bought at the grocery store but not so much when bought at restaurants.

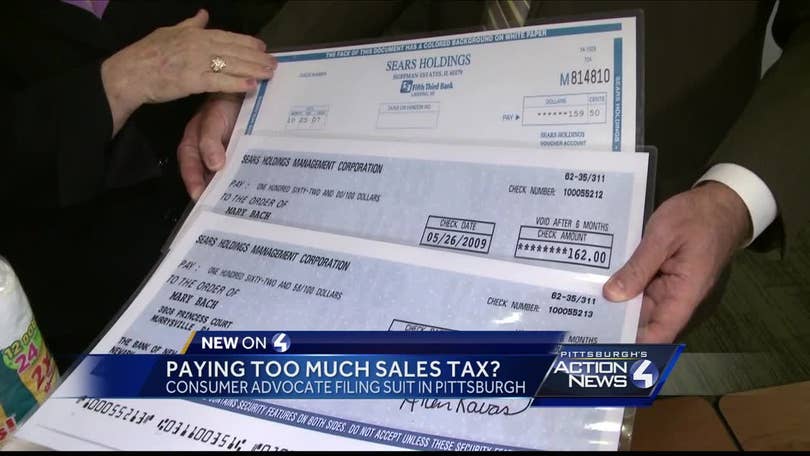

Some Sapulpa Businesses Charging Too Much Sales Tax By Mistake Https T Co Nui3ofvvkq Https T Co 95t9qlkz0y Roofing Roofer Oklahoma

We include these in their state sales.

. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when purchased from a caterer or an eating establishment from which ready-to-eat foods and beverages are sold such as a restaurant cafe lunch counter private or social club tavern. The amount of 1085 therefore is subject to tax. This page describes the taxability of food and meals in Pennsylvania including catering and grocery food.

What is the tax on fast food in Pennsylvania. Baked goods such as cookies muffins cakes pastries and breads are subject to PA sales tax ONLY when sold by an eating establishment The term eating establishment is defined as. Right now there are hundreds of things exempt from the states.

In Pennsylvania you dont have to pay sales tax on dry ice. This means that depending on your location within Pennsylvania the total tax you pay can be significantly higher than the 6 state sales tax. By Jennifer Dunn August 24 2020.

No part of the information on this site may be reproduced for profit or sold for profit. We have a certain amount of food items that are comped each day for managers owners and possibly mistakes made in food or servi. Pennsylvanias sales tax can be very confusing.

To learn more see a full list of taxable and tax-exempt items in Pennsylvania. These are typically products that are considered ready-to-eat and do not include pre-packaged meat eggs cheese or milk. Yes T Food including food supplements and prescription food T Grooming NT Medicines and medical supplies NT Veterinarian services NT Boarding sitting or walking NT Flea collars flea powder.

Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166 on top of the state tax. Taxes on sales in Pennsylvania are 6. The sales tax rate is 6.

The Pennsylvania state sales tax of 6 is applicable statewide. Maximum Local Sales Tax. 172 SUBTOTAL1317 Sales Tax 6510.

How Your State Handles Food Trucks and Sales Tax. Mary owns and manages a bookstore in Altoona Pennsylvania. Of course sales tax isnt the only tax food truck owners have to worry about.

With local taxes the total sales tax rate is between 6000 and 8000. The Pennsylvania PA state sales tax rate is currently 6. A business or an identifiable location within a business which advertises or holds itself out to the public as being engaged in the sale of prepared or ready.

While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. 5 Sale of food and beverages by food retailers and nonfood retailers.

TOTAL 138210 Cs separately stated charge for liquor and the reasonable gratuity are not taxable. See the Retailers Information Guide REV-717 or the more detailed Taxability Lists for a taxable items to review subjectivity to sales tax of goods and services. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax.

The Pennsylvania sales tax rate is 6 percent. Contact the PA Department of Revenue with further questions. - Shell eggs must meet Pennsylvania Egg Refrigeration Law standards - Some pre-packaged potentially hazardous food items are subject to PA sales tax.

Or pumpkins if youre planning on one for dinner. The service charge which is not in lieu of the gratuity is taxable. Since books are taxable in the state of Pennsylvania Mary charges her customers a flat-rate sales tax of 6 on all sales.

Resources Blog Food. Pennsylvania State Sales Tax. 31 rows The state sales tax rate in Pennsylvania is 6000.

B Three states levy mandatory statewide local add-on sales taxes. Is food taxable in Pennsylvania. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

The current total local sales tax rate in Pittsburgh PA is 7000. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. What foods are exempt from sales tax in Pennsylvania.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8. Select the Pennsylvania city from the list of popular cities below to see its current sales tax rate. For more accurate rates use the sales tax calculator.

Some states or local areas may impose other types of taxes on food trucks. Calculate By ZIP Codeor manually enter sales tax. How Much Sales Tax On Restaurant Food In Pa.

Forty-six states and DC. Most people know the rules about food and clothing generally being exempt but state law details hundreds of categories and identifies those items. The December 2020 total local sales tax rate was also 7000.

Due to the limitations of HTML or differences in display capabilities of different browsers this version. This material has been drawn directly from the official Pennsylvania Code full text database. We wont cover those taxes in this article.

Pennsylvania Gaming Cash Flow Management. Calculate By Tax Rateor calculate by zip code. This includes Pennsylvanias state sales tax rate of 6 Blair countys sales tax rate of 0 and Marys local district tax rate of 0.

Depending on local municipalities the total tax rate can be as high as 8. California 1 Utah 125 and Virginia 1. The tax is imposed on mainly certain items such as foods not ready to eat candy gum most clothing textbooks computer services pharmaceutical drugs as well as residential heating fuels like oil electricity gas and coal.

In the US each state makes their own rules and laws about what products are subject to sales tax.

Is Food Taxable In Pennsylvania Taxjar

Local Peeps We Just Were Invited From Park City Diner Lancaster Knight Day Diner Lititz To Take Part In Their S O S Sharin Supportive Park City Sos

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

States With Highest And Lowest Sales Tax Rates

Quality Neuarmy Surplus Co Linocut Prints Linocut Prints

Sales Tax On Grocery Items Taxjar

Pa Unemployment Base Year Chart Sales Taxes In The United States 350 275 Of Best Of Pa Unempl Tax Chart Sales Tax

Pennsylvania Sales Tax Small Business Guide Truic

Pennsylvania S Quirky Sales Tax System Soft Drinks Are Taxed Candy Gets A Pass Pittsburgh Post Gazette

Is Food Taxable In Pennsylvania Taxjar

2020 Sales Tax Holiday Tax Holiday Plastic Drop Cloth Hurricane Supplies

Accounting Taxation How To Know Registered E Mail Id Telangana Sales Tax Https Tgct Gov In How To Know Sales Tax Income Tax Return

Http Www Taxcompany Com Bookkeeping Tax Return Labe

Understanding Sales Tax With Printify Printify Sales Tax Understanding Tax Exemption

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Finance And Financial Performance Concept Illustration Free Image By Rawpixel Com Modern Business Cards Design Business Brochure Design Vector Free

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News